What is Property Portfolio Management?

In today’s competitive real estate landscape, property portfolio management plays a critical role in driving sustainable growth and maximizing long-term returns.

It involves the intentional planning, oversight, and optimization of multiple property assets to ensure operational efficiency, balanced risk exposure, and strong financial performance.

Whether managing a small group of properties or a large-scale portfolio, effective portfolio management provides the structure needed to make informed decisions, adapt to market changes, and align investments with strategic objectives.

TL;DR

- Property portfolio management strategically oversees multiple assets to optimize performance, balance risk, and enhance financial returns.

- Core practices like asset allocation, risk management, and performance monitoring enable informed decisions and long-term growth.

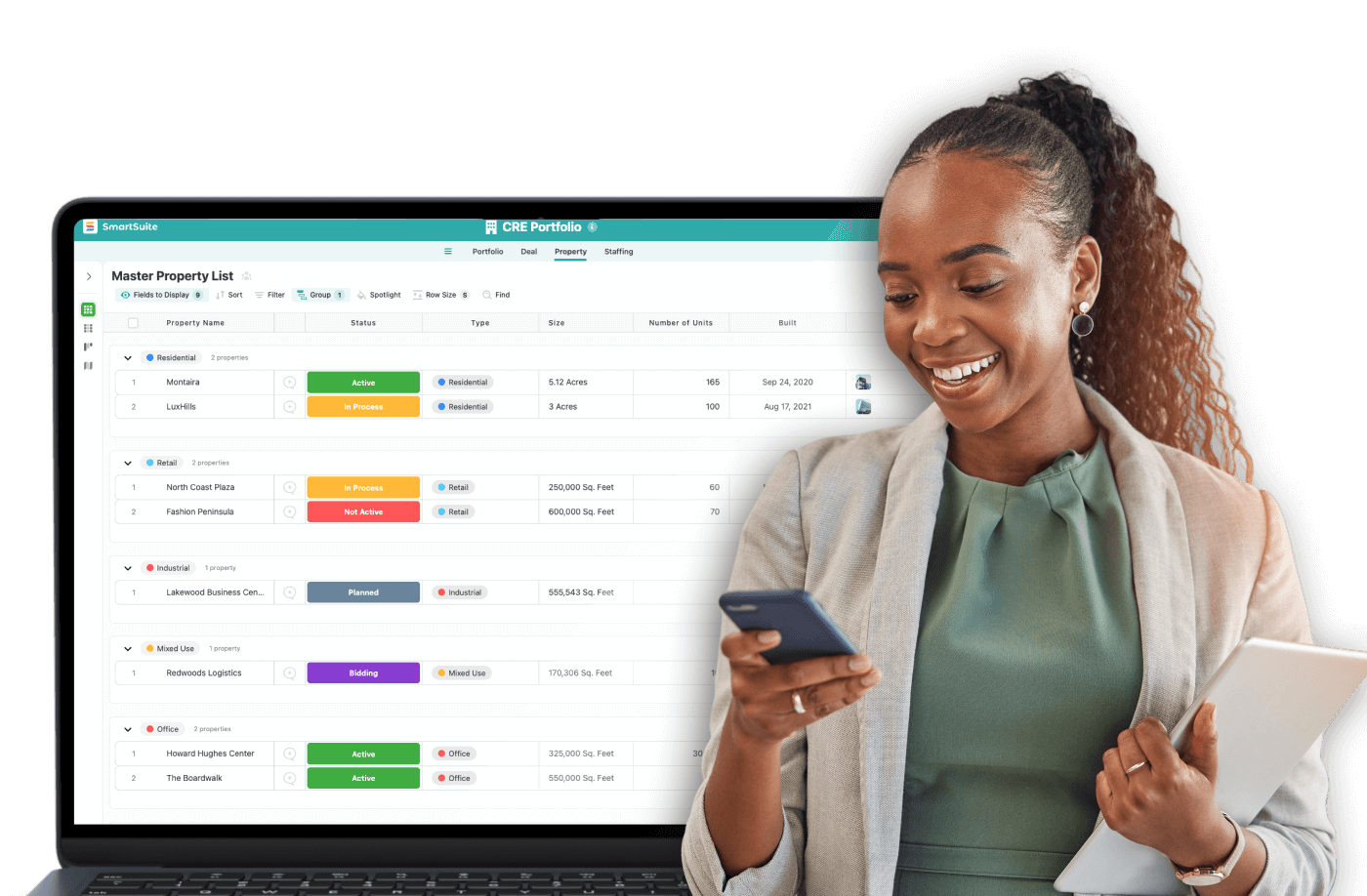

- SmartSuite empowers managers with centralized data, automated workflows, and real-time insights to optimize portfolios and drive strategic outcomes.

The Basics of Property Portfolio Management

Property portfolio management is the strategic coordination of a collection of real estate assets with the goal of optimizing overall performance, value appreciation, and return on investment (ROI). It spans residential, commercial, mixed-use, and industrial properties, focusing on aligning each asset with broader financial and operational goals.

At its core, portfolio management ensures that assets work together as a cohesive investment strategy rather than as disconnected properties.

Core Components

Asset Allocation

Distributing investments across different property types and geographic areas to balance risk and optimize return potential.

Risk Management

Identifying and mitigating exposure to market volatility, tenant instability, regulatory shifts, and operational inefficiencies.

Performance Monitoring

Continuously assessing property-level performance through key financial and operational metrics.

Strategic Planning

Making informed decisions regarding acquisitions, divestments, renovations, and redevelopments to support long-term growth.

Key Strategies in Property Portfolio Management

Market Analysis

Thorough market analysis enables portfolio managers to identify profitable investment opportunities and anticipate shifts in demand. Understanding demographics, economic indicators, and local development patterns supports smarter acquisition and disposition decisions.

Diversification

A diversified property portfolio helps reduce dependency on a single market segment. Mixing residential, commercial, and industrial assets across various regions creates resilience against market fluctuations and economic downturns.

Financial Oversight

Effective financial planning includes budgeting, expense control, forecasting, and liquidity management. These practices ensure sustainability while enabling future expansion and reinvestment opportunities.

Technology Integration

Digital systems support efficient tracking of performance, expenses, occupancy, and maintenance activities, allowing for real-time insights and more responsive decision-making.

Practical Examples

Residential to Commercial Conversion

An investor diversified a predominantly residential portfolio by converting select properties into commercial spaces based on emerging market trends. This strategic move resulted in higher rental income and increased asset value.

Sustainable Investment Strategy

By prioritizing environmentally responsible buildings, portfolio managers enhanced asset desirability while aligning with evolving tenant preferences and sustainability initiatives.

The Role of Work Management Solutions

Real-Time Visibility

Advanced dashboards and analytics provide instant insight into occupancy rates, cash flow, asset performance, and operational costs.

Workflow Optimization

Automating recurring tasks such as tenant onboarding, maintenance coordination, and reporting frees time for strategic decision-making.

Collaboration and Communication

Improved communication between stakeholders ensures alignment and accountability across property operations.

Challenges in Property Portfolio Management

Market Volatility

Fluctuations impact rental income, valuation, and capital planning, demanding proactive strategy and diversified positioning.

Regulatory Complexity

Changing zoning laws, tax policies, and compliance requirements require continual monitoring and adaptability.

Technology Adoption

Implementing new systems requires training and adaptation but delivers long-term operational advantages.

Actionable Insights for Property Managers

- Embrace structured portfolio strategies to enhance long-term value

- Prioritize performance monitoring and data-driven decisions

- Integrate technology to improve oversight and efficiency

- Invest in sustainability for future-ready portfolio positioning

- Stay informed on market trends and regulatory changes

Conclusion

Property portfolio management is an ongoing strategic discipline that balances growth, risk, and operational efficiency. When executed effectively, it enables real estate professionals to maintain stability, seize opportunities, and drive consistent performance across diverse assets.

By centralizing portfolio data, automating operational workflows, and delivering actionable insights across all properties, SmartSuite empowers portfolio managers to operate with greater precision, efficiency, and strategic clarity, transforming property portfolios into high-performing investment ecosystems.

Get started with SmartSuite Governance, Risk, and Compliance

Manage risk and resilience in real time with ServiceNow.