What Is ESG Reporting in the Energy Sector?

Environmental, Social, and Governance (ESG) reporting has emerged as a vital component for evaluating the sustainability and ethical impact of a company's operations, especially in the energy sector.

As expectations increase from investors, regulators, and communities for companies to act responsibly, ESG reporting offers a structured way to measure and communicate a company's contributions to sustainable practices.

In this article, we'll explore the intricacies of ESG reporting within the energy sector, its key components, regulatory requirements, and how platforms like SmartSuite facilitate effective ESG management.

Actionable Insights

- Adopt technology solutions to streamline ESG reporting processes.

- Stay abreast of changes in regulatory requirements and adjust practices accordingly.

- Engage with stakeholders consistently to understand and meet their expectations regarding ESG performance.

Defining ESG

At its core, ESG represents three primary components:

- Environmental pertains to the company’s impact on the planet: energy use, waste, pollution, and natural resource conservation.

- Social considers how the company manages relationships with employees, suppliers, customers, and the communities where it operates.

- Governance relates to a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

Importance in the Energy Sector

The energy sector, being one of the most resource-intensive and environmentally impactful industries, stands at the forefront of sustainability initiatives. Companies in this sector are increasingly held accountable for their ecological footprint and social responsibilities, requiring robust ESG strategies.

Components of ESG Reporting

1. Environmental Metrics

- Carbon Footprint: Quantification of CO2 emissions related to operations and efforts to reduce them.

- Energy Efficiency: Measures to ensure efficient consumption of energy resources.

- Resource Management: Monitoring and management of resource utilization, including water and minerals.

- Biodiversity Impact: Assessing the impact on local ecosystems and biodiversity preservation efforts.

2. Social Metrics

- Community Engagement: Initiatives to support and develop communities where the company operates.

- Workplace Diversity and Inclusion: Strategies to create a diverse and inclusive work environment.

- Employee Health and Safety: Policies ensuring employee welfare and safety standards.

3. Governance Metrics

- Board Diversity: Representation of diverse groups in company leadership positions.

- Ethical Practices: Transparency in business operations and adherence to ethical standards.

- Regulatory Compliance: Adhering to laws and regulations governing ESG practices.

Regulatory Landscape

Global and Local Regulations

ESG reporting is shaped by both international frameworks and local regulations. Notable frameworks include:

- The Global Reporting Initiative (GRI)

- Sustainability Accounting Standards Board (SASB)

- Task Force on Climate-related Financial Disclosures (TCFD)

Each framework emphasizes different aspects of ESG, and companies often tailor their reporting to align with these standards.

ESG Reporting Standards

Local regulations in the energy sector may impose specific reporting requirements. For instance, in the European Union, the Non-Financial Reporting Directive (NFRD) mandates certain large companies to disclose ESG information.

Benefits of ESG Reporting

Enhanced Investor Confidence

Transparency in ESG practices boosts investor confidence, showcasing a company’s commitment to sustainable development.

Risk Management

Identifying potential risks related to environmental impact, social inequities, or governance weaknesses helps companies mitigate these issues proactively.

Competitive Advantage

Companies with strong ESG performance can differentiate themselves in a crowded marketplace, appealing to customers and partners eager to work with socially responsible businesses.

Challenges and Solutions

Common Challenges

- Data Complexity: Collecting and presenting accurate ESG data can be daunting.

- Integration: Ensuring ESG goals align with overarching corporate strategies.

- Stakeholder Engagement: Satisfying diverse stakeholder expectations.

Solutions with Work Management Platforms

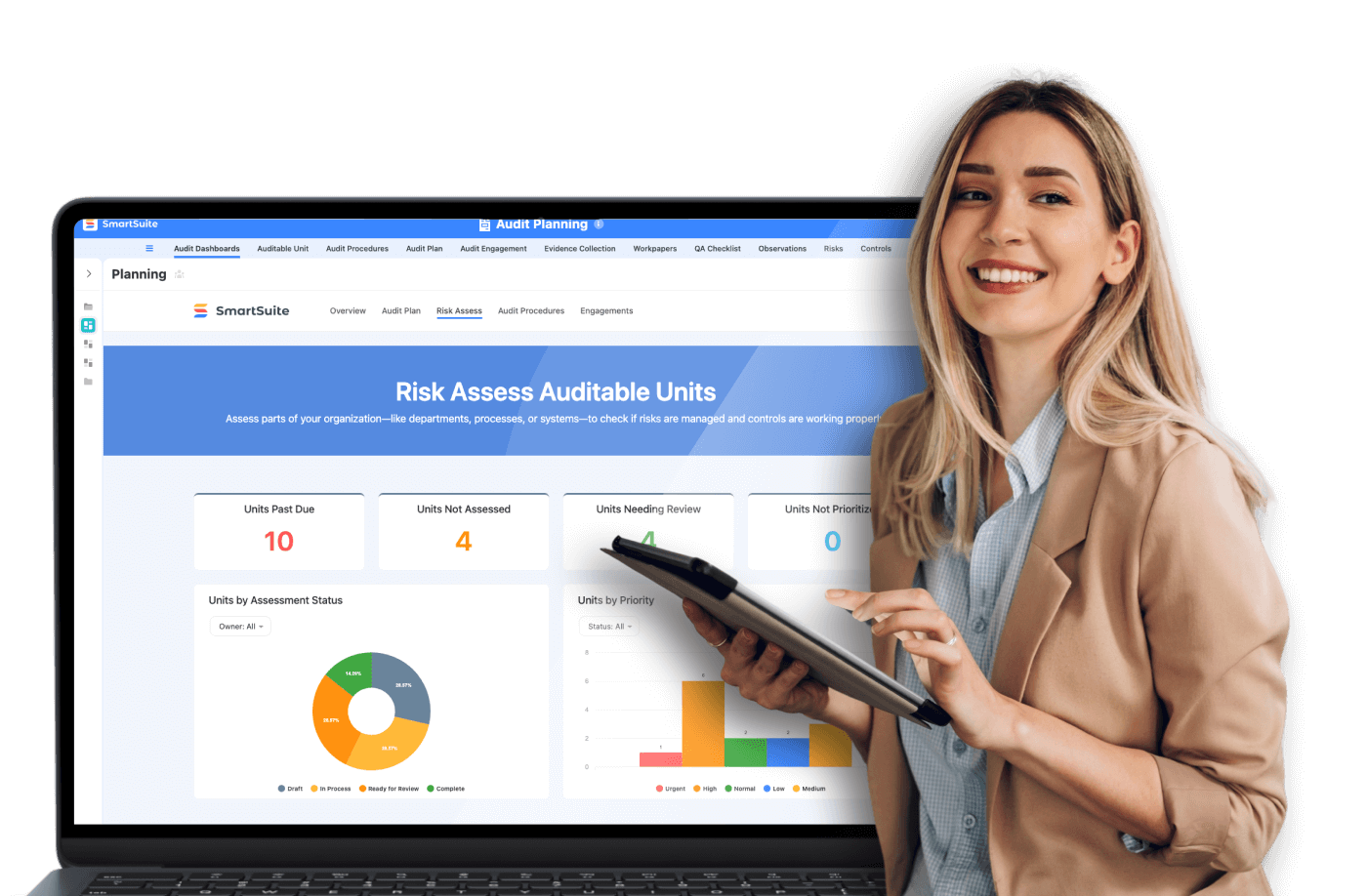

Work management platforms like SmartSuite make ESG reporting more manageable by:

- Offering centralized data collection and analysis tools.

- Integrating ESG goals with core business processes.

- Facilitating transparent communication with stakeholders through intuitive dashboards and reporting features.

Case Study: ESG Success in Action

Company Example: Solar Pioneer

Solar Pioneer, a leader in renewable energy, effectively leverages ESG reporting to drive its sustainability mission. Using SmartSuite, Solar Pioneer:

- Centralized all ESG-related data, streamlining reporting processes.

- Enhanced transparency with intuitive dashboards providing real-time updates.

- Fostered stakeholder engagement through interactive reporting and feedback loops.

Future of ESG Reporting in the Energy Sector

Technological Advances

Emerging technologies like AI and blockchain are poised to revolutionize ESG reporting by enhancing data accuracy and transparency.

Increasing Stakeholder Pressure

As awareness grows, stakeholders will demand more rigorous reporting standards, pushing companies to innovate and improve their ESG practices.

Conclusion

ESG reporting is not merely a regulatory obligation but an opportunity for energy companies to demonstrate their responsibility toward people and the planet. By leveraging robust tools like SmartSuite, companies can not only ensure compliance and transparency but also drive substantial, positive change within their operations and the broader community.

Get started with SmartSuite Governance, Risk, and Compliance

Manage risk and resilience in real time with ServiceNow.